Our Services

Business Start Up

Business start-up accounting services are like experienced guides for new business owners. They ensure your business starts on the right financial track, stays compliant with regulations, and thrives by helping you make informed financial decisions. Whether you're a novice entrepreneur or an experienced one, these services are a valuable ally in your start-up journey.

Why Is It Important?

They help set up robust financial systems, ensuring a strong foundation, legal compliance, and effective tax strategies. These services keep financial records organised, making it easier to track progress, attract investors, and control costs. They regularly assess your startup's financial health, catch issues early, and reduce your time and stress. As your business grows, they adapt and provide insights to scale your financial strategies, making startup accounting services a crucial ally for anyone starting a new business.

Tax Accounting

Tax accounting is like a trusted rulebook for handling your taxes properly and efficiently. It's a specialised branch of accounting that ensures individuals and businesses follow tax laws and regulations while accurately calculating their tax liability. Tax accountants act as referees, preventing overpayment or underpayment of taxes.

Why Is It Important?

Tax accounting excels at uncovering deductions to reduce your tax bill and navigate the complex and ever-changing tax landscape, shielding you from penalties or audits. They also serve as financial advisors, helping with tax-efficient decisions like structuring businesses and retirement planning. In essence, tax accounting offers peace of mind, saves time, and is essential for both personal financial security and the success of businesses by providing a solid legal and financial foundation.

Accounting

Accounting involves the systematic documentation, categorisation, and consolidation of financial transactions occurring within a business, encompassing both incoming and outgoing funds. It plays a pivotal role in offering a comprehensive insight into your organisation's financial well-being and its operational effectiveness.

Why Is It Important?

Accounting data reveals your company's financial performance, shedding light on whether it's generating profits or incurring losses. This data isn't solely for your benefit; it's also accessible to external parties like investors, stakeholders, and creditors. They seek this information to gain insights into your business, determining whether it's a worthwhile investment and what potential returns they can anticipate. Moreover, beyond its role in fostering transparency for stakeholders, accounting empowers you to make well-informed decisions grounded in factual data.

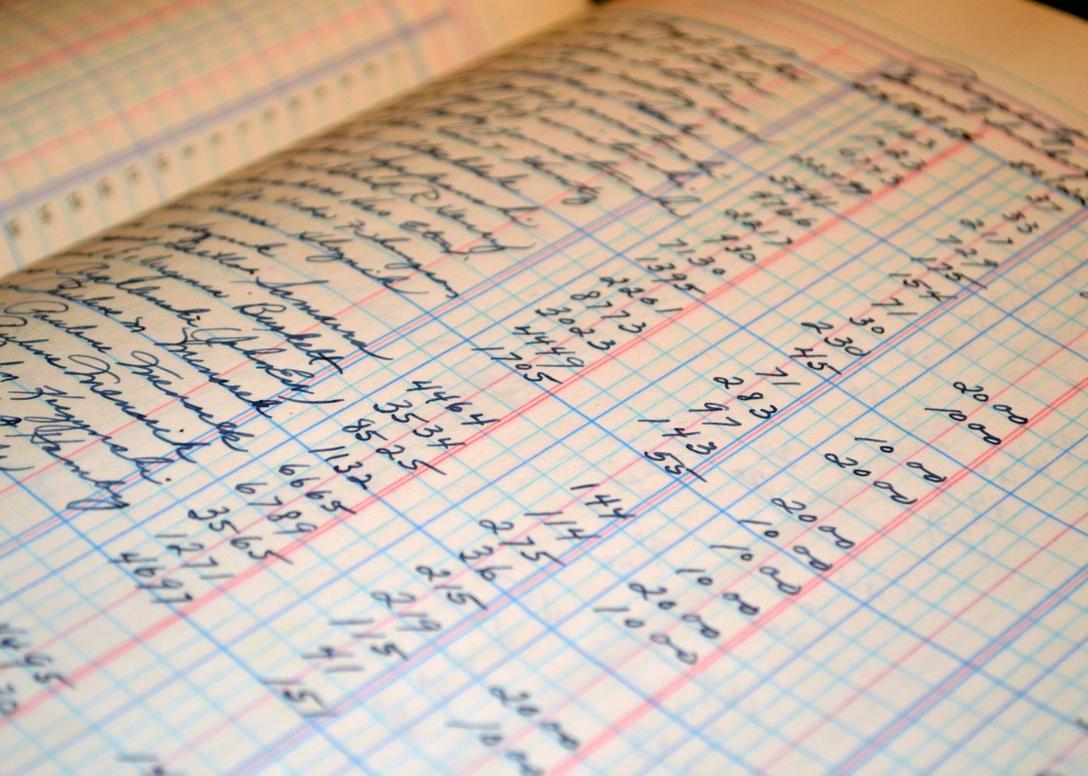

Bookkeeping

Bookkeeping is the practice of recording and tracking the financial transactions of your business. Its primary objective is to maintain impeccable accuracy in documenting each individual financial transaction, ensuring that these records remain both correct and current. By doing so, bookkeeping creates a comprehensive and reliable financial trail that serves as the bedrock of effective financial management.

Why Is It Important?

Detailed and thorough bookkeeping is crucial for businesses of all sizes. Seemingly straightforward, bookkeeping quickly becomes more complex with the introduction of tax, assets, loans, and investments. Tracking the financial activities of a business is the truest purpose of bookkeeping, meaning it allows you to keep an up-to-date record of the current incoming and outgoing amounts, amounts owed by customers and by the business, and more.